Recognize opportunities in noise

Despite concerns about the erratic US trade policy and the growing US national debt, the stock markets are approaching new highs. Investors are well advised not to be guided by short-term headlines, but to make targeted investments in long-term growth areas. The best opportunities often arise in market noise – for example in infrastructure investments that benefit from several structural trends and at the same time bring stability and diversification to the portfolio.

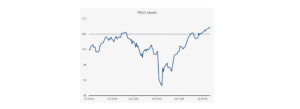

New highs

Two months after the US president’s tariff hammer, it is clear that the shock has been digested. The global stock markets have not only stabilized, but are already back at all-time highs.

This may seem surprising at first glance, as the causes of the slump two months ago are still unresolved.

Where does the optimism of investors come from?

Firstly, it is clear that even a US president cannot act without limits: The checks and balances of the judiciary, parliament, the electorate – and not least the capital markets – are having an effect.

Secondly, the economic impact of US import tariffs averaging 15 percent has so far been limited. Many companies and consumers have adjusted to this. So far, the economy has also proved remarkably robust in the face of the numerous uncertainties.

Thirdly, the global decline in inflationary pressure is giving central banks more leeway to respond to economic risks with monetary policy.

Our recommendation from previous months remains unchanged in June: Stay invested and focus your investment strategy on long-term growth areas.

Looking ahead through uncertainty

The short-term risks are offset by attractive opportunities: Interest rate cuts, structural productivity gains from AI and moderate valuations continue to offer potential for respectable returns. Rather than being tempted by the daily noise into hectic reallocations, we see significantly more opportunities for success in recognizing attractive long-term investment themes.

One theme that is being driven by several megatrends – digitalization, urbanization, climate change and deglobalization – is infrastructure. In a world full of geopolitical tensions, inflation risks and structural upheaval, it stands for stability and predictable returns.

Infrastructure: Stability in a changing world

Whether electricity grids, digital networks, transport routes or water supply – infrastructure forms the backbone of our everyday lives and our economy. The income from such investments is often protected against inflation, secured over the long term and largely independent of economic cycles. For investors, this offers attractive opportunities to combine stable current income with low volatility.

In addition, far-reaching changes are driving up demand for infrastructure worldwide: the expansion of renewable energies, digitalization, the investment backlog in aging networks and the relocation of critical production capacities will lead to an enormous need for capital in the coming years – and thus to attractive opportunities for returns.

Infrastructure: opportunities in public and private markets

In order to exploit the long-term potential, we invest both in listed companies with an infrastructure character and in unlisted investments:

- Georg Fischer: Supplier of modern water and gas supply infrastructure.

- Holcim: Leading building materials group with a central role in sustainable infrastructure development (green building, cement recycling).

- Sika: Specialty chemicals company with innovative solutions for global infrastructure projects.

- Swisscom: Backbone of digital infrastructure in Switzerland.

- Veolia: Global provider of water, waste and energy management.

- Swiss Life Privado Infrastructure ELTIF: Broadly diversified fund with a focus on European direct investments, including in data centers, toll roads and energy supply.

| Div.-Rendite | KGV 25 | |

| Georg Fischer | 2.1% | 22.0 |

| Holcim | 3.2% | 15.6 |

| Sika | 1.6% | 27.2 |

| Swisscom | 4.6% | 20.0 |

| Veolia | 4.6% | 13.8 |

Quelle: Asset Management Tareno

Publisher: Tareno AG, Gartenstrasse 56, 4052 Basel, Tel. +41 61 282 28 00, info@tareno.ch, www.tareno.ch. We welcome feedback on our publication. This content is for information purposes only. The publication contains neither legal nor investment advice or investment recommendations and does not constitute an offer or solicitation to make an investment.

Images / graphics: The graphics were produced by Tareno AG from public market data.

Do you have any questions on this topic?

Our portfolio management team will be happy to provide you with explanations and clarifications.

Find out more about us

Asset management

Publications