Tareno Water Fund 2026 again awarded the highest rating of the FNG-Label

December 2025

The Tareno Global Water Solutions Fund has once again been awarded the FNG-Label, receiving three out of three possible stars for the third time in a row.

“In 2018, we were the first water fund ever to receive the FNG-Label. The requirements have risen continuously since then. We are therefore all the more pleased that we were once again able to achieve the highest score in the more demanding assessment framework,” comments Stefan Schütz, fund manager at Tareno.

Stricter evaluation criteria strengthen the credibility and significance of the award

With the FNG Seal 2026, the assessment principles have been significantly enhanced. In particular, the areas of product governance, institutional credibility and security selection have been deepened and aligned more closely with current regulatory standards and ESG reporting obligations.

Specific ESG key performance indicators (KPIs) are now included in the assessment. This increases the informative value of the evaluation and allows an even more differentiated assessment of the underlying sustainability strategy.

The seal provides an even more reliable basis for decision-making for both private and institutional investors who value a holistic and comprehensible approach to sustainability. At the same time, we see the increasing requirements as an opportunity to continuously develop our sustainability approach. This allows us to clearly position ourselves on the market with a credible, verified investment solution.

About the FNG-Label

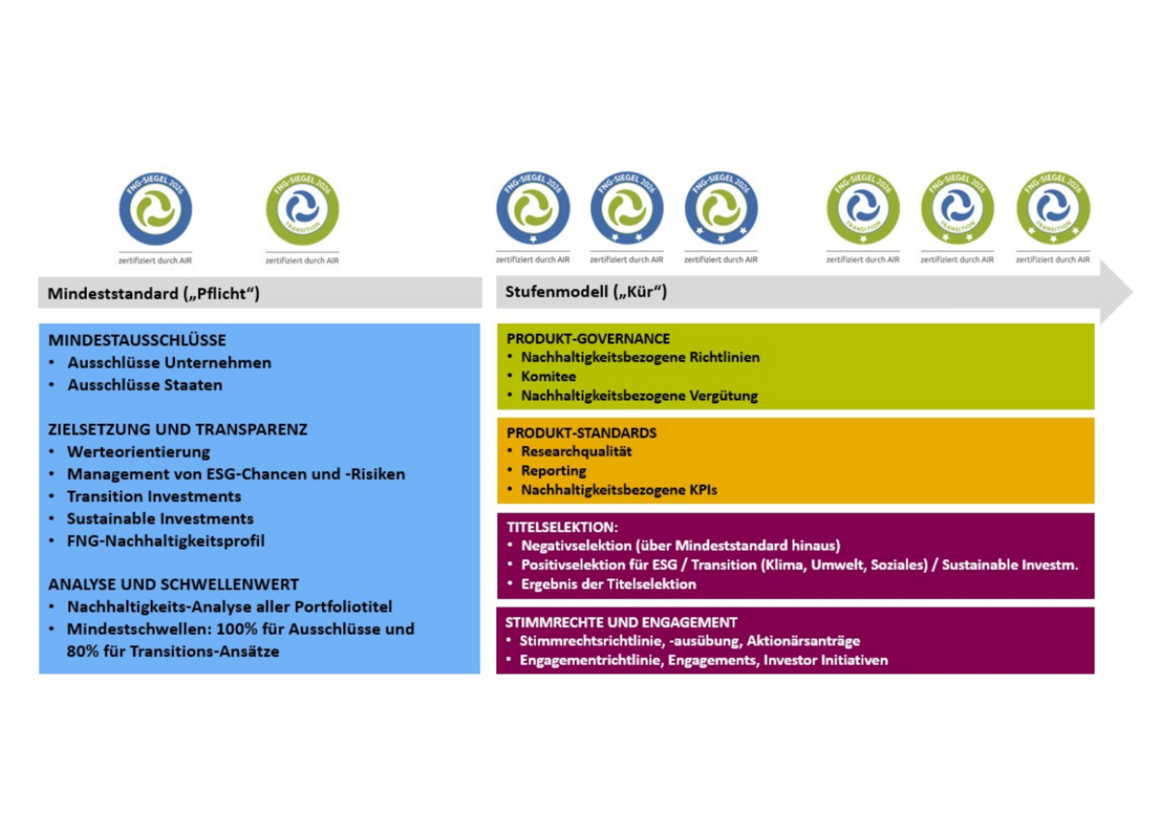

The FNG-Label has been awarded since 2015 and is the leading quality standard for sustainable mutual funds in German-speaking countries. It is awarded annually on the basis of a structured review process and is based on the principle of minimum sustainability standards, supplemented by a differentiated in-depth review with a tiered model.

For basic certification, funds must, among other things, comply with clear exclusion criteria (e.g. for weapons, coal or human rights violations), disclose a comprehensible ESG strategy and provide evidence of its integration into the investment process.

In an advanced scoring model with high requirements, funds can achieve one to three stars, depending on the quality and depth of the sustainable investment strategy. Among other things, transparency, commitment, stock selection, product structure and the institutional credibility of the provider are assessed.

The label of quality:

- ensures holistic quality of sustainable investments

- guarantees minimum standards

- audits externally and independently

- oriented in the search for credible sustainability investments

- promotes the dissemination and further development of sound and sustainable investment approaches

Find out more about us

Publications Water Fund

Sustainability & impact investing